Inspecting the first quarter of 2024 in vitro diagnostic results, we may be getting to growth without the “ifs, ands, or buts.” Four years out from the pandemic, that is a reasonable goal.

What do we mean by that? IVD test markets – markets for chemistries, critical care, infectious disease tests, cancer tests, have always been growing, even through the pandemic. This is a time of aging populations and healthcare expansion around the world. COVID-19 revenues were seen in such large numbers that they then depressed revenue growth later. So companies adjusted, offering explained results. “core revenues are up” etc. But eventually, one expects growth in in vitro diagnostic revenues without having to mention “we are growing in our core areas,” or “excluding COVID-19.” Even though it was fair to make those distinctions in the post-Omicron revenue drop. Investors needed to be told that the industry was selling a lot of cardiac markers while sales of home tests might be dropping.

Now a few firms have halted the decline in overall revenues. Take Roche, which now has 2 quarters of positive “no ifs, ands, or buts” growth.

We start with Roche, as per the chart below has recovered from the big growth decline. “2024 is the last year we expect COVID impact on our year-over-year performance,” said Matt Sause, CEO of Roche Diagnostics in Roche’s recent Q1 earnings call. Not only is the firm showing greater, but they had installed-based gains last year in most instruments and had new products to discuss, a malaria test, a respiratory panel, TBI, and other items.

The chart below, of Roche’s reported overall growth rate provides a visual on that change, 1Q 2024 is the second positive growth since the general decline of COVID testing in Q2 2022.

While Roche’s core (non-COVID) business has always grown during this period, now the overall business is.

As Roche goes IVD?

Not exactly – it is necessary to look at other companies to call a trend because Roche’s growth might come at the expense of other concerns. Abbott, for instance, is highly dependent on COVID-19 revenue having been the leader during the pandemic. In their Q1, they report revenues 17% down from the previous quarter, but up 5.4% with COVID-19 excluded. (I’ll add that with glucose considered, the company in all testing products, is highly competitive).

bioMérieux

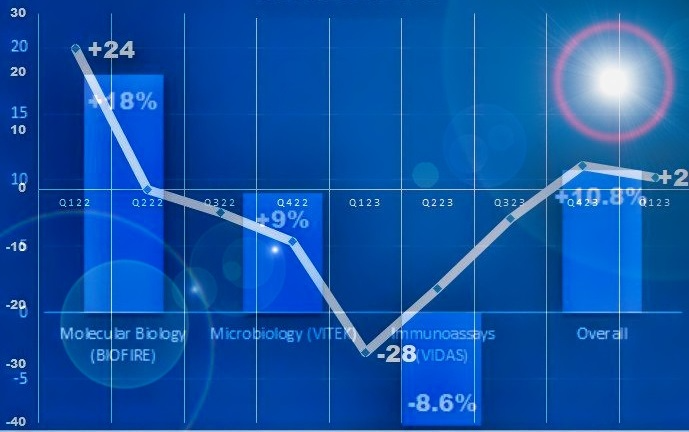

Yet take a look at French infectious disease specialist bioMérieux. The company’s BIOFIRE business, reflected in its Molecular Biology segment, is extremely healthy, with high double-digit growth.

Overall, they are up 11% from 2023 first quarter. Immunoassays are down a bit, which is COVID-19 impacted. (they also believe some overpurchasing by labs in previous quarters settling out).

If we look at Siemens Healthineers, Q1 2024 pulled in less revenue than Q1 2023, but only 3% less. Down but recoverable, I think.

Considering the cautious optimism in the 1Qs, the predictions made by many analysts in 2020 may be true:

Within a five-year forecast from the COVID-19 pandemic, the rest of IVD would make up for the COVID-19 crest and replace those revenues.

Bold in 2020. Now, seems about right. We are on the track, and a few longer-term trends are originating from the pandemic such as molecular system expansion, automation, respiratory panels, and, sadly for the little guys – increased consolidation of both labs and IVDs. As we go into the ADLM conference end of this month, EYE ON IVD will be reporting on where we stand on all of those trends.

399 Subscribers, waiting for that 400th!!

Please tell someone else if you think they may benefit from this newsletter.

Note that EYE ON IVD will be at ADLM (former AACC) – thanks to the press staff for allowing us the opportunity.