Among the many predictions made in our latest webinar, “Very Cutting-Edge Trends in IVD” was that we can expect a “lab-in-a-box” type system to receive FDA approval within the next 2 years. We’ll explain why here.

But first – we wanted to highlight our EYE ON IVD End of The Year Sale on All of Our Market Research, w/Discounts up to 20%. Visit our Research Shop Now for details: https://eyeonivd.com/research-report-shop/

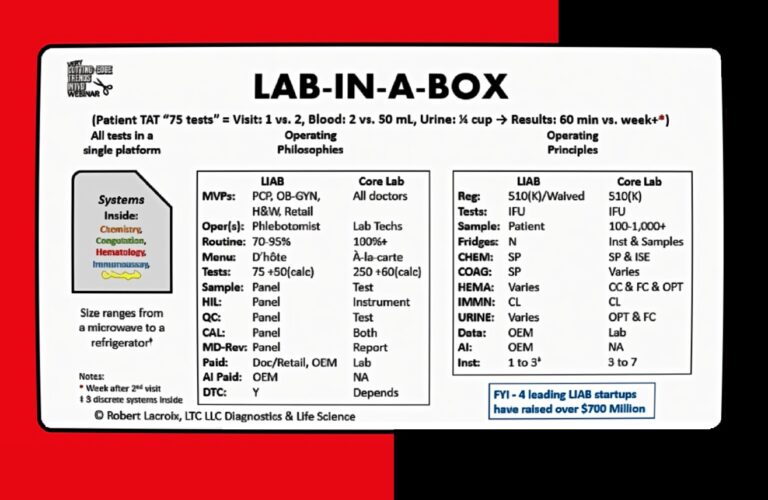

Lab-in-a-box systems, ranging in size from a printer to a refrigerator, were once the stuff of talk, but have since made progress in development. This according to Eye on IVD’s “Very Cutting-Edge Webinar” held last Wednesday. The webinar featured Rob Lacroix from LDC, LCC, David Freestone from BridgeworX (formerly Cue, Cepheid) and Frank Criscione from Broadbranch. These systems could have business benefits both for the IVD companies who make them and for practices.

The “lab in a box” concept is centered on accessibility, convenience, and knowledge. It offers patients a comprehensive range of tests with a rapid turnaround time. The webinar discussed one system can handle up to approximately 75 tests, divided into about 55 blood tests and 20 urine tests. Compared to the traditional core lab process, this system significantly enhances efficiency.

The customer goes online, orders their test, comes in, gets gets the sample drawn. 60 minutes later, they have the result. [The doctor] bills, has the credit card on file. I think that’s a winning solution for retail and healthcare. – Rob Lacroix, LDC, LLC

With “lab in a box,” patients can complete all testing in a single visit, whereas a core lab typically requires at least two visits. The blood sample required is minimal—only about two milliliters, compared to the 50 milliliters usually needed in a core lab. Similarly, the urine sample needed is just a quarter cup.

Most importantly, the turnaround time for patients is drastically reduced. From the moment blood and urine samples are collected to the time results are reviewed with a doctor, the process takes approximately 60 minutes. In contrast, the standard timeline for core labs extends to a week or more. This rapid turnaround provides patients with timely results and empowers healthcare providers to make quicker decisions.

Said LDC LLC’s Robert LaCroix: “Think about retail, retail and healthcare. You know, you hear all these stories about these big the biggest companies in the world getting involved. And then they they d put off after a year or two because it’s not successful. The customer goes online, orders their test, comes in, gets the sample drawn. 60 minutes later, they have the result. I’ve billed, I have the credit card on file. I think that’s a winning solution for retail and healthcare.”

There’s opportunity here. And from a time period, I’m on the record as saying, you know, I think that at least one of these companies will have FDA clearance by 2026, and I’m actually comfortable enough to say by 1 to 2, we’ll have it by ADM of 2026. There’ll be FDA approved. I think they’re that close. I don’t have any inside knowledge on that. But that’s just from what I’m seeing. And if you think about it, there’s also other potential players here.

NEW METAGENOMIC TEST

The way I describe metagenomics is, what if you ask an employee: “How are you doing with your work today?” rather than “Did you get to Mr. Smith’s file yet?” Both have their place but serve different purposes. Metagenomics is a method of testing that accounts for environmental material in the sample, thus it utilizes that more “open question” that could provide more unknowns. The closed question can only be a “yes,” “no.”

The way I describe metagenomics is, what if you ask an employee: “How are you doing with your work today?” rather than “Did you get to Mr. Smith’s file yet?” Both have their place but serve different purposes.

When sampling for next-generation sequencing (NGS) in a traditional fashion, the process is typically designed to isolate and sequence a specific target, such as the genome of a known organism or a particular gene of interest. This approach by its nature not only reduces focus on other biological material in the sample, but treats it as “background noise” and filters it out with computerized and to achieve high precision for the intended target.

Metagenomics challenges this traditional paradigm by embracing the “ignored” or less-studied components of a sample. Instead of focusing solely on the known or desired material, metagenomics sequences all genetic material present

(Just so it’s clear, there are times when closed questions are needed, i.e. Mr Smith wants to know about progress… And there are many cases, such as a suspected infection or cancer, where a targeted sequencing will always be preferable.)

A 2019 NEJM study (DOI:10.1056/NEJMoa1803396) found “Routine microbiologic testing is often insufficient to detect all neuroinvasive pathogens.” yet “metagenomic NGS of CSF obtained from patients with meningitis or encephalitis improved diagnosis of neurologic infections and provided actionable information in some cases.” The study enrolled 204 pediatric and adult patients at 8 hospitals who were severely ill. A total of 58 infections of the nervous system were diagnosed in 57 patients, among these 58 infections, metagenomic NGS identified 13 (22%) that were not identified by clinical testing at the source hospital.

Delve Bio, using research from University of California San Francisco, announced the commercial launch of Delve Detect, its groundbreaking metagenomic test for infectious diseases. Built on the platform developed at University of California San Francisco (UCSF), Delve Detect offers genomic testing of cerebrospinal fluid (CSF) for more than 68,000 pathogens, with 48-hour turnaround time and metagenomics experts readily available to discuss results.

In diagnostics, metagenomics can reveal unexpected factors influencing disease, such as co-infections, microbial interactions, or novel pathogens. This holistic view could lead to the discovery of entirely new diseases or redefine existing ones, potentially altering diagnostic strategies and treatment plans.

AMP SAYS LDT RULE PUTS LABS IN LIMBO, CALLS FOR HELP FROM IVD

At the Association for Molecular Pathology (AMP) annual meeting, members received an update on the organization’s lawsuit challenging the FDA’s final rule on laboratory-developed test (LDT) regulation. While many attendees supported the legal challenge, uncertainty lingered about how laboratories should prepare for the impending regulations, set to take effect in early spring.

Additionally, AMP urged manufacturers of Research Use Only (RUO) reagent kits commonly used in LDTs to consider seeking FDA clearance, and warned against RUO products being overly marketed as IVDs without that status.

AMP CEO Laurie Menser described the situation as “limbo,” highlighting the ambiguity in the rule’s language. The association’s focus is threefold: pursuing the lawsuit, exploring alternative strategies to counter the rule, and assisting members in preparation for implementation.

AMP emphasized the rule’s financial burden, estimating one-time compliance costs at $113.9 billion and annual costs at $14.3 billion. They warned of potential adverse effects on innovation, patient access, and supply chains. The core of AMP’s lawsuit questions the FDA’s authority over LDTs. The FDA contends it has jurisdiction, citing decades of enforcement discretion but argues that the increasing complexity and usage of LDTs necessitate stricter oversight.

Additionally, AMP urged manufacturers of Research Use Only (RUO) reagent kits commonly used in LDTs to consider seeking FDA clearance as medical devices to align with evolving regulatory expectations.

DIAGNOSTIC SALES HELPS QIAGEN PLEASE WALLSTREET IN Q3.

Qiagen reported Q3 2024 revenues of $502 million, a 5% increase year-over-year (6% at constant exchange rates), exceeding Wall Street expectations. Key growth drivers included a 10% rise in diagnostic solutions revenue to $197 million, with QuantiFeron sales climbing to $122 million (+10%) and QiaStat-Dx sales increasing 41% to $28 million. Qiagen said it placed 150 QiaStat-Dx systems during the quarter, supporting its goal of $200 million in annual QiaStat-Dx revenues by 2028.