hird quarter results are in at some the major in vitro diagnostic test companies. The market for IVD tests beyond COVID-19 is expanding. Companies are boosting their chemistry, immunoassay, traditional infectious disease business, their “core” businesses. This is evident. When exclusions are made and context is given, there are some positive results.

But the amount of growth is not particularly exciting, and there are some declines from 2023.

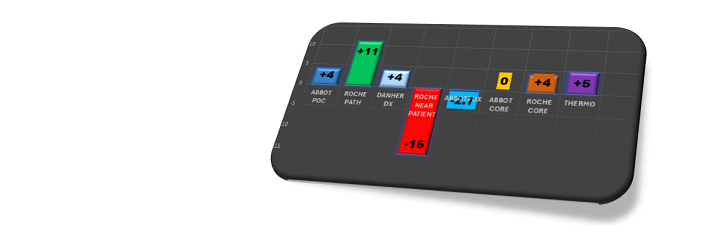

Starting with: Abbott’s diagnostic business declined overall, a slight revenue decline to $2.41 billion Q3 2024 from $2.45 billion Q3 2023. Once COVID-related testing is excluded, the news is brighter. Abbott Rapid Diagnostics, absent COVID tests, shows flat Q3 revenues year to year. That’s something of an achievement as this is the unit that includes IDNOW instruments and supplies associated with COVID-19. It’s clear the company is finding sales for other respiratory condition tests. In addition. Abbott noted a 4% increase in its Point-of-Care division including iSTAT and other non COVID-19 tests. Abbott’s Core Lab segment was flat year after year.

Roche, on the other hand, saw its diagnostics revenues rise 6% in Q3, reaching CHF 3.52 billion (approximately USD 4.05 billion). However, this is pathology-driven. Core Lab revenue increased by just 4%, while pathology surged 11%. Roche’s path revenues were driven up by advancements in staining techniques and companion diagnostics. Although COVID-19 testing fell significantly, and Roche’s near-patient care revenues were down 15%, Roche’s base diagnostics business maintained solid growth. Roche maintains its beginning of the year prediction of “mid single digits” growth in diagnostics.

Better news at Thermo Fisher Scientific, where the companies diagnostic segment outperformed the company in Q3, with Specialty Diagnostics revenue growing by 5% to $1.13 billion for the quarter, despite overall flat company growth.

Danaher experienced a 5% increase in Q3 sales, largely driven by double-digit gains in Cepheid’s core diagnostics, which the company says “includes both respiratory and non-respiratory assays.” However, Danaher noted that growth could have been higher if not for a slowdown in Chinese sales, as customers awaited news on government stimulus in the region.

QuidelOrtho, bioMerieux and Bio-Rad have yet to report revenues.

A REMINDER ABOUT EYE ON IVD’s Infectious Disease IVD Trends and Opportunity Webinar – November 6th 2024, 2PM. We’ll talk about innovative products, companies to watch, trends to watch, key geographies. There are 45 Registrants so far! – Not to Late to Sign up: