The Association for Diagnostic and Laboratory Medicine (ADLM) conducted a survey of clinical labs and the results are troubling. If the ADLM survey results extrapolate to the whole clinical lab population, six thousand of the twelve thousand U.S. labs developing and performing these tests may just stop doing them.

Why does this matter? With all the talk of lab-developed tests, it might be easy to lose sight of their purpose. Most of the time, they are designed to make up for what is not otherwise available. Labs conduct their own tests for rare diseases, such as Huntington’s disease, cystic fibrosis, Gaucher’s disease, and muscular dystrophy, diseases that affect only a small subset of the population.

This limited patient pool reduces the incentive for manufacturers to develop commercial diagnostic tests, as the market is small and offers little to no return on investment. Additionally, existing tests may not apply to certain subpopulations from which a lab has patients, requiring modifications to the test for accurate results.

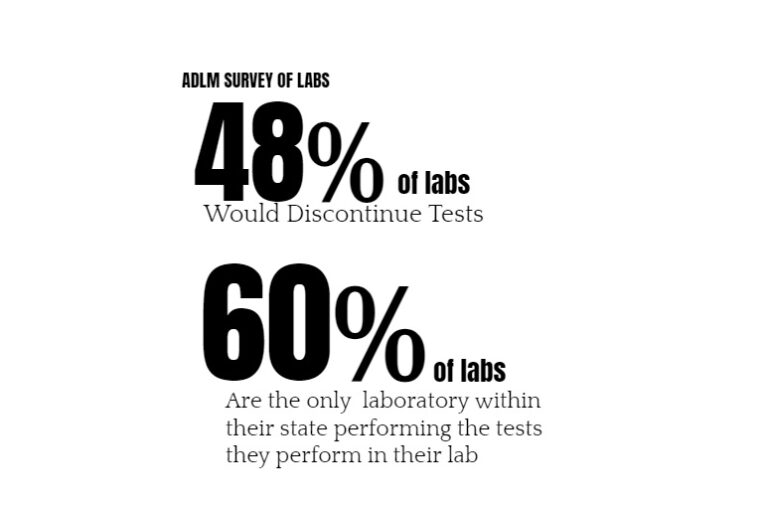

Those tests and custom modifications cannot be done if clinical labs need to create the regulatory compliance office of a medical device company. That’s at least what we can glean from ADLM’s survey. The survey asked labs across the U.S., if the new rule goes into effect, will they seek FDA authorization for their laboratory developed tests or will they discontinue them? Forty-eight percent of respondents (n=121) said that they would discontinue their tests, which is a deeply concerning finding. According to the FDA, there are approximately 12,000 laboratories qualified to perform laboratory developed tests in the U.S. (out of a total of more than 300,000 clinical labs), which means that nearly 6,000 will stop offering these critical tests.

As a follow-up question, the survey then asked labs, if they were to stop performing their laboratory developed tests, is there another laboratory within their state that would offer the discontinued tests? More than 60% of respondents said that there is no alternative laboratory within their state that offers the laboratory developed tests that they perform. This means that FDA’s rule will create a significant hardship for many individuals — particularly among rural and historically marginalized communities — who do not have the means to travel to obtain access to the tests needed to diagnose and treat their conditions.

Now to be clear, this is a survey of 159 laboratories. I for one like a little bit higher sample size for confidence than that, maybe 2x. But I’ve done small-sample before and found them insightful. Even if it’s a third of labs this is scary. ADLM extrapolates that their survey means nearly one half or 6,000 labs performing LDTs may stop offering these tests if they must comply with the new oversight.

Advanced mass spectrometry, oncology tests, genetic and pediatric tests may not survive if the rule continues.

The ADLM survey can be found here: https://www.myadlm.org/lp/ldts-survey

Another result of the survey: labs say that they are not necessarily avoiding oversight, but if there is to be more regulation or strict standards, those should come from CMS.

IVD and LTDs: Barry Manilow Effect

I’ve said it numerous times here, but what happens to labs affects IVD vendors. There’s a theory that IVD companies will like the new FDA LDT rule, because it limits competition and ensures all tests “regardless of source” get FDA clearance. One of the industry groups AvaMedDx, supported the proposed and final rule. However they also encourage and if one reads their statements in a way, would prefer, Congressional legislation.

Absent from most 2Q 2024 statements and earnings calls reviewed by this author was any great exuberance over the opportunity to scoop up test sales share from university medical centers.

It doesn’t feel like IVD is celebrating. Absent from most 2Q 2024 statements and earnings calls reviewed by this author was any great exuberance over the opportunity to scoop up test sales share from university medical centers. That is not to say plans are not out there. With a few companies, and within a few disease categories, there well may be opportunity. Three factors (at least) cloud the positives for vendors.

- LDT Supplies Are Part of the IVD Market: There’s a healthy business for companies selling reagents and dedicated instruments to perform LDT tests. Some companies sell more than others. I think of Thermo Fisher, Qiagen, DiaSorin. Thermo spends a fair amount of time cultivating this market (https://www.thermofisher.com/us/en/home/clinical/clinical-genomics/molecular-diagnostics/molecular-diagnostic-education.html) But there are plenty of companies where, especially if the ADLM survey proves true, will feel the results in their balance sheet.

- LDTs are performed to adjust or improve IVD products: An LDT is not always a completely novel test, it can utilize a manufacturer product in a different way, with a different sample type, or a small adjustment to manufacturer specifications. Per a 360DX article, Thermo is already thinking about this. Do Vendors want to tackle that customer service, are they set up to do so?

- Labs are IVD customers. Even if not a single reagent is sold by an IVD vendor to a lab for LDTs, poor finances at a lab might harm routine purchases. You have that Barry Manilow Effect [“I feel sad when you’re sad”] if they lose budget, fire staff or reduce operations because of declining LDT revenues or patient migration, that cannot be good for their vendors.